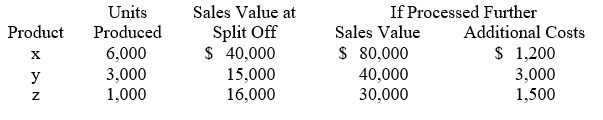

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product Z using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product Z using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Net Present Value

A method used in capital budgeting to assess the profitability of an investment or project by calculating the difference between the present value of cash inflows and outflows.

Average Rate of Return

A monetary measurement for assessing an investment's profit efficiency, determined by dividing the yearly average profit by the cost of initial investment.

Cash Payback

A capital budgeting method that estimates the time required for an investment to generate cash flows sufficient to recover its initial cost.

Internal Rate of Return

A financial metric used in capital budgeting to estimate the profitability of potential investments, calculated as the discount rate that makes the net present value of all cash flows from a particular project equal to zero.

Q12: Which of the following is not an

Q13: What strategic factors/considerations are generally relevant to

Q23: The 95% confidence range for a prediction

Q41: Kumar Co. is attempting to predict its

Q43: New Hope Corporation manufactures replacement windshield wiper

Q47: Standard costs are:<br>A)Planned costs the firm should

Q75: Total equivalent units for Material P under

Q82: C.M. Fly, owner of Falcon Aircraft Co.,

Q90: If 24,000 hats were sold, Grant's operating

Q142: Using ABC, how much other overhead is