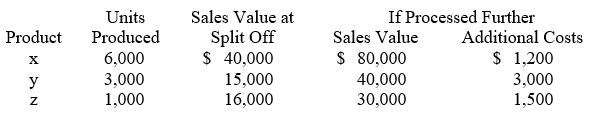

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product Z using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product Z using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Business Strategy

A plan of action designed by organizations to achieve defined goals, compete in the market, and improve financial and market performance.

FA/Sales Ratio

A financial ratio that compares a company's fixed assets to its sales revenue, indicating how well assets are being used to generate sales.

Fixed Assets

Long-term tangible assets used in the operation of a business and not expected to be converted to cash in the short term.

Cash Generated

The amount of money produced by a company's normal business operations after accounting for operational expenses and working capital.

Q2: Total budgeted inventory purchases in November by

Q62: Brownsville's budgeted cost of goods sold (CGS)

Q68: Opportunity costs are:<br>A)Not used for decision making.<br>B)The

Q69: The amount of joint costs allocated to

Q69: Atlantic Manufacturing Company uses process costing. All

Q70: Label Corp. recorded sales of $2,235,245. The

Q89: The income statement for a manufacturing company

Q92: Using the firm's volume-based costing, applied factory

Q94: Walker Corp. is a retail store that

Q95: Which of the following items does NOT