Demski Company has used a two-stage cost allocation system for many years. In the first stage, plant overhead costs are allocated to two production departments, P1 and P2, based on machine hours. In the second stage, Demski uses direct labor hours to assign overhead costs from the production departments to individual products A andB.

Budgeted factory overhead costs for the year are $300,000. Both the budgeted and actual machine hours in P1 and P2 are 12,000 and 28,000 hours, respectively.

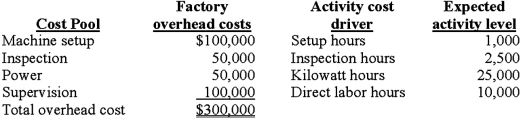

After attending a seminar to learn the potential benefits of adopting an activity-based costing system (ABC), Ted Demski, the president of Demski Company, is considering implementing an ABC system. Upon his request, the controller at Demski Company has compiled the following information for analysis:

Demski manufactures two types of product, A and B, for which the following information is available:

Demski manufactures two types of product, A and B, for which the following information is available:

Required:

Required:

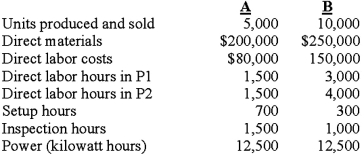

1. Determine the unit cost for each of the two products using the traditional two-stage allocation method. Round calculations to 2 decimal places.

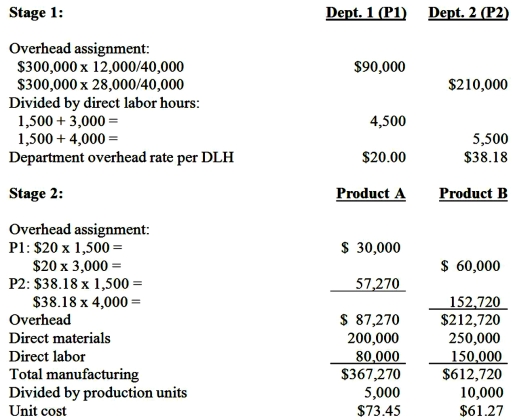

2. Determine the unit cost for each of the two products using the proposed ABC system.

3. Compare the unit manufacturing costs for product A and product B computed in requirements 1 and 2.

(a) Why do two the cost systems differ in their total cost for each product?

(b) Why might these differences be important to the Demski Company?

Answer may vary

Feedback: 1. Unit cost for each of two products using the traditional two-stage allocation method:

Definitions:

Creative Imagery

The use of imaginative and visual content to communicate ideas or promote products in marketing and advertising.

Automobile Quality

The standard of excellence or the state of being free from defects, deficiencies, and significant variations in vehicles, evaluated through the assessment of various attributes including durability, reliability, and performance.

Product-Specific

Refers to information or characteristics unique to a particular product, distinguishing it from others.

Rephrasing

The act of expressing an idea or concept in different words or a new manner, often to clarify meaning or enhance understanding.

Q1: Elena randomly asks students of a class

Q14: Manufacturing firms use which of the following

Q27: Adam measures the length of time two

Q28: Which one of the following is not

Q34: Which of the following would likely not

Q72: Cost per equivalent unit for conversion under

Q80: JIT (Just in time) methods are designed

Q83: Variable costs within the relevant range for

Q91: The direct method of departmental cost allocation

Q95: Daley Co. manufactures computer monitors. Following is