Castenet Company uses a volume-based costing system that applies overhead cost based on direct labor hours at $250 per direct labor hour.

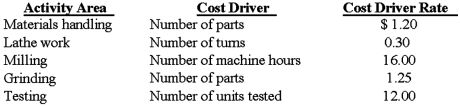

The company is considering adopting an activity-based costing system with the following data:  The two jobs processed in the month of June had the following characteristics:

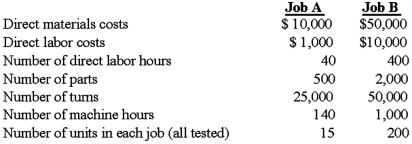

The two jobs processed in the month of June had the following characteristics:  Required:

Required:

1. Compute the unit manufacturing cost of each job under the firm's current volume-based costing system.

2. Compute the unit manufacturing cost of each job under the activity-based costing system.

3. Compare the unit manufacturing cost for Jobs A and B computed in requirements 1 and 2.

(a) Why do the two cost systems differ in their total cost for each job?

(b) Why might these differences be important to the Company?

Definitions:

Present Value

The current valuation of future monetary sums or cash flow streams, using a given return rate for discounting.

Capital Cost Allowance (CCA)

A taxable expense in Canada that a business can claim for the depreciation of tangible property.

Required Rate Of Return

The lowest annual return percentage that persuades individuals or companies to commit capital to a particular project or security.

Net Working Capital

The difference between a company's current assets and current liabilities, indicating its short-term liquidity.

Q11: Overhead costs are allocated to cost objects

Q22: Many products in the marketplace today are

Q29: Using activity-based costing, applied engineering and design

Q35: Cleaning Care's margin of safety (MOS) in

Q38: Cost management information typically is the responsibility

Q50: Normal spoilage and abnormal spoilage should be

Q54: All of the following are examples of

Q61: What is the estimated total cost at

Q106: Cost Pools and Cost Drivers Based on

Q132: General corporate sales expenditures are:<br>A)Customer unit-level costs.<br>B)Customer