Demski Company has used a two-stage cost allocation system for many years. In the first stage, plant overhead costs are allocated to two production departments, P1 and P2, based on machine hours. In the second stage, Demski uses direct labor hours to assign overhead costs from the production departments to individual products A andB.

Budgeted factory overhead costs for the year are $300,000. Both the budgeted and actual machine hours in P1 and P2 are 12,000 and 28,000 hours, respectively.

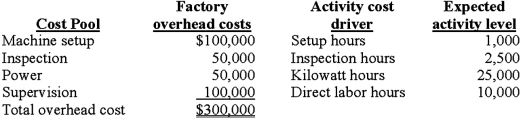

After attending a seminar to learn the potential benefits of adopting an activity-based costing system (ABC), Ted Demski, the president of Demski Company, is considering implementing an ABC system. Upon his request, the controller at Demski Company has compiled the following information for analysis:

Demski manufactures two types of product, A and B, for which the following information is available:

Demski manufactures two types of product, A and B, for which the following information is available:

Required:

Required:

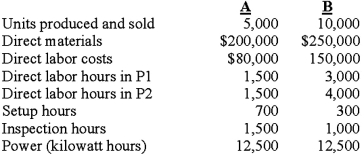

1. Determine the unit cost for each of the two products using the traditional two-stage allocation method. Round calculations to 2 decimal places.

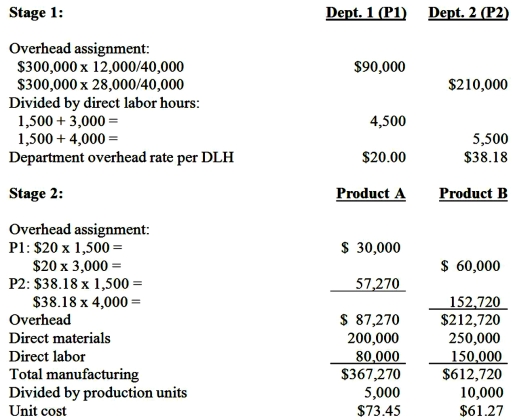

2. Determine the unit cost for each of the two products using the proposed ABC system.

3. Compare the unit manufacturing costs for product A and product B computed in requirements 1 and 2.

(a) Why do two the cost systems differ in their total cost for each product?

(b) Why might these differences be important to the Demski Company?

Answer may vary

Feedback: 1. Unit cost for each of two products using the traditional two-stage allocation method:

Definitions:

Schemas

Mental structures that an individual uses to organize knowledge and guide cognitive processes and behavior.

Gender Schemas

Cognitive frameworks that organize information related to gender, influencing how individuals perceive and engage in gendered behaviors and roles.

Less Respect

The condition of being regarded with diminished esteem or honor.

Attributions

The process by which people explain the causes of their own and others' behaviors, often categorizing these explanations into internal or external factors.

Q20: In the late 1990s, the bicycle maker

Q20: Cost per equivalent unit for conversion under

Q24: Fashions, Inc. is a retail store that

Q34: Factory overhead costs for a given period

Q43: Job costing in the printing industry often

Q52: Total equivalent units for materials under the

Q65: The competitive strategy in which the firm

Q96: Which of the following activities is a

Q113: An activity that is performed for each

Q114: A company allocates its variable factory overhead