The following information is for Stier Company for the month of November:

a. Factory overhead costs are applied to jobs at the predetermined rate of $80 per labor-hour. Job X-14 incurred 2,300 labor-hours; Job SM-4 used 1,850 labor-hours.

b. Job X-14 was shipped to customers during November.

The company closed the overapplied or underapplied overhead to the Cost of Goods Sold account at the end of November

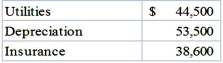

c. Factory utilities, factory depreciation, and factory insurance incurred is summarized by these factory vouchers, invoices, and cost memos:  d. The Company purchased the following direct materials and indirect materials:

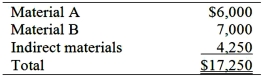

d. The Company purchased the following direct materials and indirect materials:  e. Direct materials and indirect materials used are as follows:

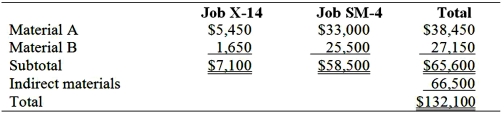

e. Direct materials and indirect materials used are as follows:  f. Factory labor incurred for the two jobs and indirect labor is as follows:

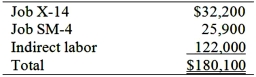

f. Factory labor incurred for the two jobs and indirect labor is as follows:  Required:

Required:

1.Calculate the amount of overapplied or underapplied overhead and state whether the cost of goods sold account will be increased or decreased by the adjustment.

2.Calculate the total manufacturing cost for Job X-14 and Job SM-4 for November.

Definitions:

2-Year-Old

A term describing a child who has reached the age of two, a stage often characterized by rapid growth, learning, and development.

Progressive Loss

A gradual decrease in function, quality, or quantity over time, often associated with health conditions or disease progression.

Presbycusis

Age-related hearing loss, gradually occurring as individuals get older, affecting the ability to hear higher frequencies first.

Otosclerosis

A condition characterized by abnormal bone growth in the middle ear, leading to hearing loss.

Q4: Some of the indicators of a growing

Q22: Dr. Baumgartner wants to study how a

Q34: Which of the following would likely not

Q39: Rockingham Manufacturing Company builds highly sophisticated engine

Q42: The total cost accumulated in the assembly

Q60: The journal entry to record requisitioned and

Q65: The differentiation strategy requires all of the

Q67: Conversion costs are the sum of direct

Q70: Using activity-based costing, applied machinery overhead for

Q133: Service and not-for-profit organizations often:<br>A)Have ABC systems