The following information is for Stier Company for the month of November:

a. Factory overhead costs are applied to jobs at the predetermined rate of $80 per labor-hour. Job X-14 incurred 2,300 labor-hours; Job SM-4 used 1,850 labor-hours.

b. Job X-14 was shipped to customers during November.

The company closed the overapplied or underapplied overhead to the Cost of Goods Sold account at the end of November

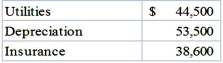

c. Factory utilities, factory depreciation, and factory insurance incurred is summarized by these factory vouchers, invoices, and cost memos:  d. The Company purchased the following direct materials and indirect materials:

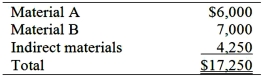

d. The Company purchased the following direct materials and indirect materials:  e. Direct materials and indirect materials used are as follows:

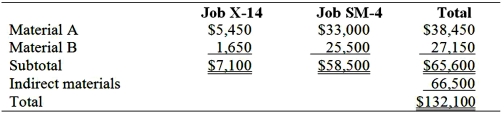

e. Direct materials and indirect materials used are as follows:  f. Factory labor incurred for the two jobs and indirect labor is as follows:

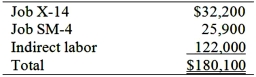

f. Factory labor incurred for the two jobs and indirect labor is as follows:  Required:

Required:

1.Calculate the amount of overapplied or underapplied overhead and state whether the cost of goods sold account will be increased or decreased by the adjustment.

2.Calculate the total manufacturing cost for Job X-14 and Job SM-4 for November.

Definitions:

Duty of Care

The legal obligation to avoid acts or omissions which could foreseeably harm others.

Negligence

A failure to exercise the care that a reasonably prudent person would exercise in similar circumstances, leading to harm or damage.

Professional Designation

A formal certification demonstrating a certain level of expertise or specialization in a particular field, frequently required in professions such as law, medicine, and accounting.

Professional Associations

Organizations founded by individuals in the same profession aimed at advancing their interests, standards, and development.

Q11: The percent of the total variance that

Q24: Harrison allocates factory overhead on the basis

Q25: Gordon Manufacturing produces high-end furniture products for

Q41: Total equivalent units for conversion under the

Q56: A strategy map is:<br>A)A detailed flowchart outlining

Q59: Studebaker Corporation, one of the earliest auto

Q91: What is the amount of net sales?<br>A)$68,500.<br>B)$94,000.<br>C)$72,500.<br>D)$75,000.

Q98: The income statement for a merchandising company

Q114: If overhead is applied based on machine

Q118: Using activity-based costing, applied materials handling factory