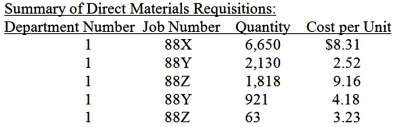

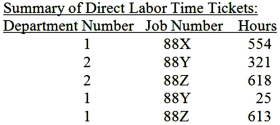

Boston Manufacturing Company had the following cost information for May.

The labor rate in Department 1 is $10.50 and in Department 2 is $9.50. The overhead rate in Department 1 is based on direct labor-hours, at $4.50 per hour; in Department 2 the rate is 125 percent of direct labor cost. Boston had no beginning work-in-process inventory for May.

The labor rate in Department 1 is $10.50 and in Department 2 is $9.50. The overhead rate in Department 1 is based on direct labor-hours, at $4.50 per hour; in Department 2 the rate is 125 percent of direct labor cost. Boston had no beginning work-in-process inventory for May.

Required: Calculate the direct materials, direct labor, factory overhead, and total costs for each job.

Definitions:

Organizational Hierarchy

A system within a company or organization that ranks positions in an ascending order of authority and responsibility.

Flexible Benefit Plans

These are employee benefit programs that allow workers to choose from a range of benefits to tailor their compensation package to their personal needs and preferences.

Concealing

The act of hiding something or preventing it from being known or seen.

Economic Value

The worth of a good or service as determined by the market or the value it brings to the transaction.

Q11: Overhead costs are allocated to cost objects

Q18: Prime cost and conversion cost share what

Q25: Which of the following statements is true

Q27: In the context of systematic observation, the

Q39: Conversion costs in a process cost system

Q49: What are the unit conversion costs?<br>A)$2.15.<br>B)$2.36.<br>C)$2.50.<br>D)$2.75.

Q65: Johns Company manufactures products R, S, and

Q65: The key distinction between job costing and

Q83: All of the following items are debited

Q95: Riverside Company manufactures two sizes of T-shirts,