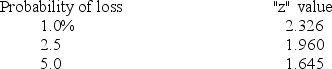

A portfolio has an average return of 14.2 percent and a standard deviation of 12.85 percent.Given this,you should expect to lose at least ________ percent on an annual basis once every century.

Definitions:

Fiscal Year

A one-year period used for financial reporting and budgeting that may not align with the calendar year.

Internal Rates Of Return

The financial rate that ensures a project's cash flows have a net present value of exactly zero.

Maximum Discount Rate

The highest interest rate set by a central bank to lend money to financial institutions.

Internal Rate Of Return

A metric used in financial analysis to estimate the profitability of potential investments, calculated as the rate of return that makes the net present value of all cash flows equal to zero.

Q10: A portfolio has a beta of 1.25

Q27: Which one of the following describes a

Q32: A stock is valued at $25.80 a

Q41: A Sharpe-optimal portfolio provides which one of

Q42: Which one of the following is a

Q51: A 6-month put has a strike price

Q56: A portfolio has a Jensen's alpha of

Q64: Which one of the following is the

Q86: A bond has a dollar value of

Q99: The spot price on orange juice is