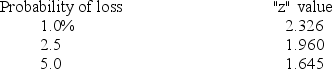

You have a portfolio which has an average return of 10.3 percent.In any given year,you have a 2.5 percent probability of earning either a zero or a negative annual return.What is the approximate standard deviation of your portfolio?

Definitions:

Labor Time

The amount of work time that employees spend on various tasks, often measured to analyze productivity or allocate labor costs.

Industrial Engineers

Professionals who design, develop, test, and evaluate integrated systems to manage industrial production processes including human work factors, quality control, inventory control, logistics, material flow, cost analysis, and efficiency.

Standard Costs

Predetermined costs for products or services, used for budgeting and measuring performance.

Governmental Agencies

Governmental agencies are official organizations, often established by the government, responsible for administering specific functions and regulations at various levels, such as federal, state, or local.

Q20: What is the Treynor ratio of a

Q22: Which one of the following is generally

Q27: A stock fund has a standard deviation

Q28: Four of the last five stocks your

Q53: Whole Wheat Farms,Inc.has a net income of

Q66: An option that would not yield a

Q67: You own 1,500 shares of ABC stock

Q73: A portfolio comprised of which one of

Q76: Which one of the following rates is

Q77: Which one of the following statements is