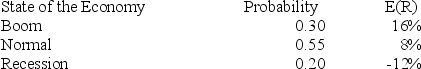

The risk-free rate is 3.0 percent.What is the expected risk premium on this security given the following information?

Definitions:

Capital Lease

A lease arrangement that transfers substantially all the risks and rewards of ownership of an asset to the lessee, essentially treated as a purchase.

Retained Earnings

The portion of net earnings not paid out as dividends but instead reinvested in the company or used to pay off debt.

Deferred Income Taxes

Taxes applicable on income that is recognized in financial statements in one period but is taxable in another period.

Income Taxes Payable

Income taxes payable is a liability account on a company's balance sheet representing the amount of income taxes that the company owes to the government but has not yet paid.

Q12: A list of available option contracts and

Q19: The slope of the security market line

Q47: The Grand Isle has 12,000 shares of

Q52: Which one of the following statements is

Q53: Dynamic immunization is primarily aimed at reducing

Q56: Which one of the following combinations will

Q63: According to the concept of house money,individual

Q77: Russ paid a total of $75 to

Q90: A bond pays semiannual interest payments of

Q93: Which one of the following theories states