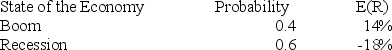

What is the expected return on this stock given the following information?

Definitions:

Speculative Forward Contract

A financial derivative used to speculate on the future price of an asset, involving an agreement to buy or sell the asset at a future date for a price determined today.

Fair Value Hedge

A risk management technique that uses financial instruments to mitigate the risk associated with changes in the fair value of an asset or liability.

Firm Commitment

An agreement between a buyer and an underwriter in which the underwriter guarantees the sale of a certain amount of securities.

Cash Flow Hedge

A hedging strategy used to manage risk associated with variability in cash flows, typically related to interest rates or currency exchange rates.

Q7: Which one of the following best describes

Q14: If you are a proponent of the

Q35: You have a portfolio which is comprised

Q41: A Sharpe-optimal portfolio provides which one of

Q42: You have a portfolio which is comprised

Q44: You want to create the best portfolio

Q47: For a premium bond,the:<br>A) current yield is

Q57: The market rate on a bond fell

Q60: A portfolio consists of the following two

Q65: What is the covariance of security A