Multiple Choice

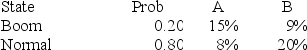

You have a portfolio which is comprised of 60 percent of stock A and 40 percent of stock B.What is the expected rate of return on this portfolio?

Definitions:

Related Questions

Q16: Approximately how many years did it take

Q17: Tim purchased 5 put option contracts on

Q31: You own 5,000 shares of Miller stock

Q55: Assume that a large corporation,such as General

Q58: A portfolio consists of the following securities.What

Q61: Which one of the following is an

Q62: All else held constant,which of the following

Q62: Which one of the following increases the

Q84: A decrease in which one of the

Q94: A change in a bond's price caused