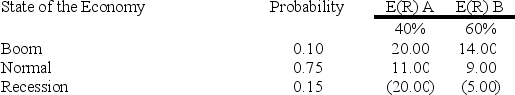

You have a portfolio which is comprised of 40 percent of stock A and 60 percent of stock B.What is the portfolio standard deviation?

Definitions:

Scientific Theories

Systematically organized knowledge applicable in a relatively wide variety of circumstances, especially a system of assumptions, accepted principles, and rules of procedure to analyze, predict, or explain the natural phenomena.

Inconsistent Statement

A situation where two or more statements are contradictory, making them unable to be true at the same time.

Truth Values

The attribution of either _true_ or _false_ to propositions, in logic.

Antecedent Statement

A statement that comes before another in a logical sequence, often providing a cause or reason for the subsequent statement.

Q3: A 4-month,$25 call option on Teller stock

Q8: Which one of the following terms best

Q9: You have a portfolio which is comprised

Q16: Which one of the following statements is

Q24: Which one of the following is a

Q41: You have a portfolio which is comprised

Q52: A stock is currently selling for $20.65.A

Q70: Arbitrage traders:<br>A) tend to be well-capitalized.<br>B) tend

Q92: The bond equivalent yield adjusts for leap

Q94: You are considering buying shares of stock