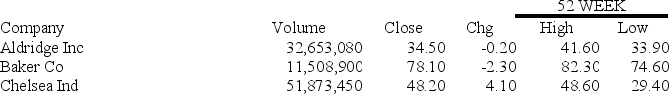

Use the following stock quotes to answer this question:

-A pension fund purchased 20 round lots of Chelsea Company stock at the closing price of the day yesterday.What was the cost of that purchase?

Definitions:

Filing Jointly

Filing jointly refers to a tax filing status that allows married couples to combine their income and deductions on a single tax return, potentially leading to tax benefits.

Net Book Value

The value of an asset or liability according to a company's balance sheet, deducting depreciation or amortization.

Accumulated Depreciation

Accumulated depreciation is the total amount of depreciation expense that has been recorded against a fixed asset over its useful life to date.

Depreciation Expense

The allocation of the cost of a tangible fixed asset over its useful life, reflecting the consumption or wear and tear of the asset.

Q5: Lansing Corporation reported net income of $65

Q7: At the beginning of the year,you invested

Q27: Sun Lee purchased 1,500 shares of Franklin

Q48: Eight months ago,Freda purchased 500 shares of

Q55: Small-cap funds:<br>A) generally focus on dividend-paying stocks.<br>B)

Q58: Assante Corporation reported the following data for

Q67: You want to purchase shares in a

Q68: Under the periodic inventory method, if merchandise

Q72: Market prices tend to _ earnings "surprises".<br>A)

Q82: You purchased eight put option contracts with