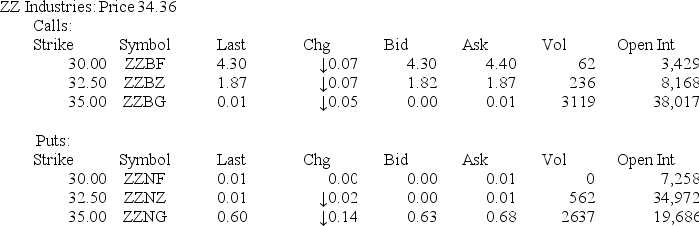

Use these option quotes to answer this question:

-You want the right,but not the obligation,to sell 400 shares of ZZ Industries stock at a price of $32.50 a share.How much will it cost you to establish this option position?

Definitions:

Production Shutdown

The temporary or permanent cessation of manufacturing operations, often due to economic downturns or maintenance.

Lean Operations

An approach that aims at reducing waste in manufacturing processes while also enhancing productivity.

Accounting

An information system that provides reports to stakeholders about the economic activities and condition of a business.

Transactions

Economic events that are recorded in the financial statements, involving transfers or exchanges of goods, services, or funds between entities.

Q8: Which one of the following trading symbols

Q13: If the financial markets were regulated such

Q19: A survey of 55 of your fellow

Q19: Efficient markets tend to exist:<br>A) only when

Q31: At the beginning of the year,you invested

Q52: A price-weighted index consists of stocks A,B,and

Q64: Which of the following are offered as

Q76: Joanne invested $15,000 six years ago.Her arithmetic

Q122: The Giovanni Company purchased a tooling machine

Q134: Which of the following would NOT be