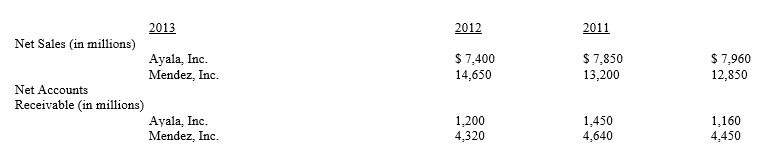

The following are summary financial data of the three most recent years for two companies:

a. Using the data above, compute the accounts receivable turnover and average collection period for each company for 2013 and 2012. (Round to two decimal places)

b. Which company appears to have a better credit collection policy? Explain why.

Definitions:

Income Statement

A financial document that shows the company's revenue and expenses over a specific period, resulting in net income or loss.

Dollar Amounts

The numerical value that represents a specific monetary figure in terms of dollars.

Component Percentages

A method to express various parts of a financial statement as proportions of a whole to analyze component efficiency and performance.

Quality of Income Ratio

A measure that indicates the amount of earnings that are realized as cash; assessing the ability of a firm to convert its net income into cash.

Q22: Which form must be filed quarterly by

Q40: The "true" discount rate of a capital

Q51: Which of the following is the proper

Q55: The purpose of the audit committee within

Q58: Which of the following factors are used

Q66: In preparing its bank reconciliation for the

Q74: Under which inventory system would a company

Q88: The period covered by the assessment of

Q98: Selling property, plant, and equipment is a(n)<br>A)

Q127: Which inventory cost flow assumption best reflects