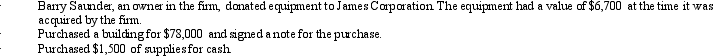

On May 1, James Corporation had total assets of $877,000. During May, the company completed the following transactions:  After these transactions were recorded, total assets would have a balance of

After these transactions were recorded, total assets would have a balance of

Definitions:

Land Improvements

Enhancements made to land to increase its value or usability, such as landscaping, fencing, or adding infrastructure like roads and utilities.

Building Appraised

The assessed value of a building, determined by a professional appraiser based on factors such as location, condition, and market trends.

Double-Declining-Balance

An accelerated depreciation technique that applies twice the depreciation rate of straight-line depreciation to hasten the reduction in an asset's recorded value.

Salvage Value

The estimated residual value of an asset after its useful life has ended, used in calculating depreciation.

Q10: On July 24, Barkdull Inc. purchased

Q17: As William is preparing the end of

Q28: What is the average cost of a

Q31: Costs incurred to repair products under warranty

Q42: Star of the Sea School has annual

Q55: The purpose of the audit committee within

Q60: In accrual basis accounting, when are expenses

Q61: Which of the following are NOT included

Q68: Refer to Exhibit 6-1. Given the information

Q105: Revenues<br>A) Decrease assets<br>B) Decrease owners' equity<br>C) Increase