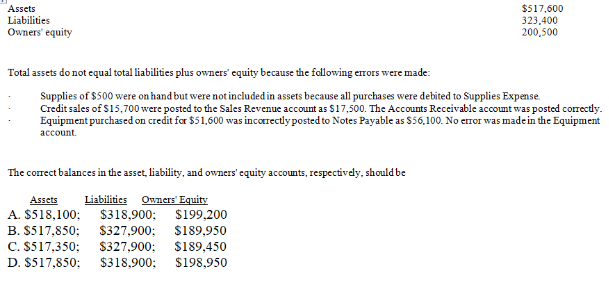

On June 30, the balances in the General Ledger accounts of Pancho Company resulted in the following totals:

Definitions:

Meal Plan

A prepaid system for purchasing meals, often used in college dining halls or by individuals planning dietary needs.

Child Tax Credit

A tax benefit that allows taxpayers to reduce their tax liability on a dollar-for-dollar basis for each qualifying child under a certain age.

AGI

Adjusted Gross Income, which is total income minus specific deductions, used to determine tax liability.

Adoption Credit

A tax credit offered by the IRS to offset some expenses involved in the legal adoption of a child.

Q1: Which of the following is NOT part

Q39: When managers are deciding how much of

Q42: Star of the Sea School has annual

Q60: You are considering the purchase of a

Q71: Which of the following is LEAST preferable

Q71: Which of the following statements is true

Q91: Refer to Exhibit 7-7. Assuming the

Q98: Which of the following types of entries

Q99: An asset is purchased for $40,000. It

Q102: Which of the following does NOT consider