This figure displays the choices and payoffs (company profits) of two music shops-MiiTunes and The Rock Shop.MiiTunes is an established business in the area deciding whether to charge its usual high prices or to charge very low prices,in the hopes that a new business will not be able to make a profit at such low prices.The Rock Shop is trying to decide whether or not it should enter the market and compete with MiiTunes.

This figure displays the choices and payoffs (company profits) of two music shops-MiiTunes and The Rock Shop.MiiTunes is an established business in the area deciding whether to charge its usual high prices or to charge very low prices,in the hopes that a new business will not be able to make a profit at such low prices.The Rock Shop is trying to decide whether or not it should enter the market and compete with MiiTunes.

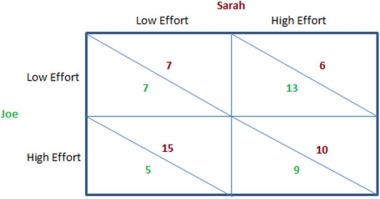

If MiiTunes and The Rock Shop are both in the music business and faced with the choices outlined in the figure,we can predict the outcome will be that:

Definitions:

Systematic Risk

The inherent risk associated with the entire market or market segment, also known as market risk.

Beta Coefficient

A means of gauging the rate of fluctuation, or uniform risk, inherent in a security or portfolio as compared to the entire market.

Treynor Index

A performance metric for determining how well an investment portfolio is compensated for taking investment risk, adjusted for market volatility.

Unsystematic Risk

The risk associated with a specific issuer of a security, such as a company's financial health or management decisions, also known as "specific risk" or "idiosyncratic risk."

Q2: A market has four individuals,each considering buying

Q11: Buying insurance and then never making a

Q38: Assume a company is at a point

Q65: A type of public policy set in

Q66: Economists call a game that is played

Q81: If Thelma's willingness to sell her homemade

Q99: Mika borrows $100,000 to start up her

Q128: This graph shows three different budget constraints:

Q133: All games involve which of the following?<br>A)

Q147: Backward induction involves:<br>A) a process of analyzing