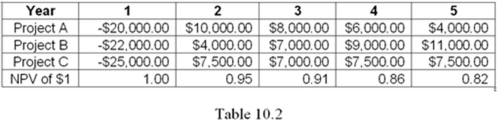

The Table 10.2 below shows net cash flows for 3 mutually exclusive projects from which a company can choose.Each project requires an investment in the first year,then produces a positive net cash flow for each of the following four years.Assuming an interest rate of 5%,which project would the company choose? Does the best project have the highest total net cash flow? The shortest payback period?

Definitions:

Q24: Characteristics of a perfectly competitive market include:<br>A)

Q29: A firm has increasing returns to scale

Q29: The extra revenue produced by the change

Q32: Refer to Figure 10.1.Suppose the individual is

Q36: Refer to Figure 9.1.What is the maximum

Q41: Which of the following is NOT a

Q48: The exchange efficiency condition holds:<br>A) if every

Q48: If technological change is factor neutral,then the

Q49: The belief that if you paid more

Q53: Behavioral economists view the standard economic theory