Given the financial information for the A.E.Neuman Corporation,

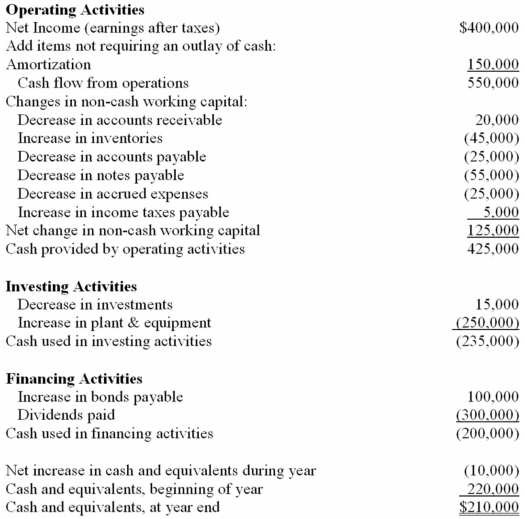

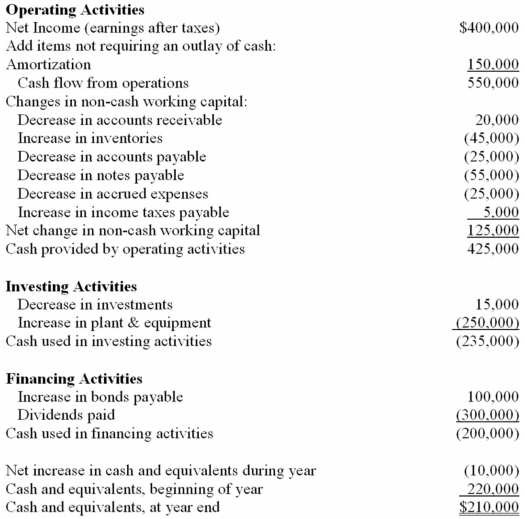

A)Prepare a Statement of Cash Flows for the year ended December 31,2015.

B)What is the dividend payout ratio?

C)If we increased the dividend payout ratio to 100%,what would happen to retained earnings?

A.E. Neuman Corporation Balance Sheet

ASSETSCash Marketable Securities Accounts Receivable Inventories Investments Total current assets Plant and Equipment Less Accumulated Amortization Net Plant and Equipment Total Assets 2014$45,000175,000240,000230,00070,000$760,0001,300,000450,000$850,000$1,610,0002015$50,000160,000220,000275,00055,000$760,0001,550,000600,000$950,000$1,710,000

LIABILITIES AND SHAREHOLDERS’ EQUITY Accounts Payable Notes Payable Accrued Expenses Income Taxes Payable Bonds Payable (2016) Common Stock (100,000 shares) Retained Earnings Total Liabilities and Shareholders’ Equity $110,00065,00030,0005,000800,000200,000400,000$1.610,000$85,00010,0005,00010,000900,000200,000500,000$1.710,000 A.E. Neuman Corporation

Income Statement

For the Year Ended December 31, 2015

Sales Less: Cost of Goods Sold Gross Profit Less: Selling, General & Administrative Expenses Operating Profit Less: Amortization Expense Eamings Before Interest and Taxes Less: Interest Expense Eamings Before Taxes Less: Taxes (50%) Net Income $5,500,0004,200,0001,300,000260,0001,040,000150,000890,00090,000800,000400,000$400,000 A)  B) Dividend payout ratio = Dividends paid, 2015 Net Income, 2015=$400,000$300,000=0.75=75% C)The 2015 value for retained earnings would decrease by $100,000.In addition,assets would have to decrease by $100,000 or other liabilities would have to increase by the same amount.

B) Dividend payout ratio = Dividends paid, 2015 Net Income, 2015=$400,000$300,000=0.75=75% C)The 2015 value for retained earnings would decrease by $100,000.In addition,assets would have to decrease by $100,000 or other liabilities would have to increase by the same amount.

Definitions:

Ice

Frozen water, often used to cool drinks, reduce swelling, or preserve food.

Complete

Fully finished or encompassing all necessary parts; lacking nothing.

Fracture

A break, breach, or crack in a bone or cartilage.

Across

From one side to the other, typically referring to movement or location spanning a space or distance.

B) C)The 2015 value for retained earnings would decrease by $100,000.In addition,assets would have to decrease by $100,000 or other liabilities would have to increase by the same amount.

B) C)The 2015 value for retained earnings would decrease by $100,000.In addition,assets would have to decrease by $100,000 or other liabilities would have to increase by the same amount.