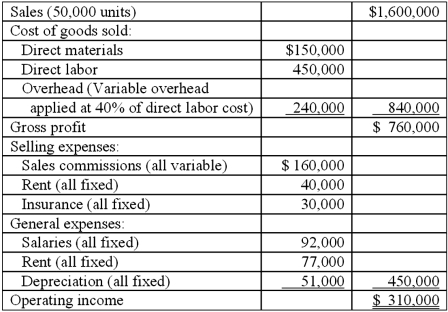

Balmer Corporation's master budget for the year is presented below:  During the period, the company manufactured and sold 42,000 units.

During the period, the company manufactured and sold 42,000 units.

Required:

1.Prepare a flexible budget (FB) for the actual output level achieved during the period.

2.What is the definition of a FB? For what managerial purpose is a FB useful? Be specific about the types of information (and variances) that management can generate, at the end of an accounting period, given a flexible budget and its master (static) budget.

Definitions:

Income Tax Expense

The amount of income taxes a company expects to pay for the current tax year, accounting for deferred taxes.

Book Income Before Income Tax

The income that a company reports on its financial statements before the deduction of income tax expenses.

Tax Depreciation

The depreciation expense allowed by tax authorities to account for the reduction in value of a tangible asset over its useful life, intended to provide a tax shield for businesses.

Book Depreciation

The portion of an asset's initial cost that is allocated as an expense over its useful life on the financial statements, according to accounting standards.

Q16: PureSwing Golf, Inc.manufactures swing analyzer systems for

Q18: The difference between the total actual sales

Q30: Oslund Company manufactures only one product

Q61: Opportunity costs are:<br>A) If significant in amount,

Q72: A truck, costing $25,000 and uninsured, was

Q82: Jackson, Inc., manufactures two products that it

Q89: Which of the following statements about the

Q96: Luanna Inc. manufactures game consoles. Some of

Q111: Gerhan Company's flexible budget for the units

Q130: The difference between variable overhead cost incurred