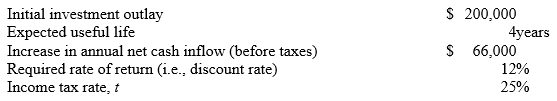

Harris Corporation provides the following data on a proposed capital project: Harris uses straight-line depreciation method with no salvage value.

Harris uses straight-line depreciation method with no salvage value.

Required:

Compute for the proposed investment project:

1. The project's estimated NPV (the PV annuity factor for 12%, 4 years is 3.037). Round your answer to nearest whole number (dollar).

2. The project's IRR (to the nearest tenth of a percent). Note: PV annuity factors for 4 years: @ 8% = 3.312; @ 9% = 3.240; @ 10% = 3.170; @ 11% = 3.102; @ 12% = 3.037; and, @ 13% = 2.974).

3. Payback period (assume that cash inflows occur evenly throughout the year); round answer to two decimal places (e.g., 4.459 years = 4.46 years, rounded).

4. Accounting rate of return (ARR) on the net initial investment, rounded to two decimal places (e.g., 10.4233% = 10.42%).

5. Discounted payback period (assume that the cash inflows occur evenly throughout the year; round your answer to 2 decimal places). The appropriate PV factors for 12% are as follows: year 1 = 0.893; year 2 = 0.797; year 3 = 0.712; year 4 = 0.636.

Definitions:

Personal Residence

A dwelling in which an individual lives for a significant part of the year, considered as their main place of residence.

Working Condition Fringes

These are non-taxable benefits provided by an employer for the benefit of the employee, related directly to the nature of the job.

Professional Organization Dues

Membership fees paid to belong to an organization related to one's professional field, which may be tax-deductible.

Employer-provided Vehicle

An employer-provided vehicle is a car or other vehicle that a company provides to its employees for their use, often as part of their compensation or benefits package.

Q14: Amanda Jones owns and operates Motorcycle Rentals

Q31: Lyman Company has the opportunity to increase

Q49: Zero Company's standard factory overhead rate is

Q59: You are provided with the following summary

Q60: Home Remodeling Inc. recently obtained a short-term

Q87: The act of encouraging non-value-adding actions on

Q104: The capital budgeting decision technique that reflects

Q104: The sales and cost data for two

Q126: Which one of the following is most

Q129: Information pertaining to Yekstop Corp.'s sales revenue