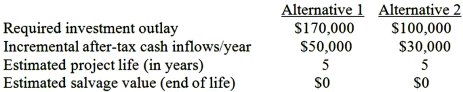

Slumber Company is considering two mutually exclusive investment alternatives.Its estimated weighted-average cost of capital, used as the discount rate for capital budgeting purposes, is 10%.Following is information regarding each of the two projects:  Required:

Required:

1.Compute the estimated net present value of each project and determine which alternative, based on NPV, is more desirable.(The PV annuity factor for 10%, 5 years, is 3.7908.)

2.Compute the profitability index (PI) for each alternative and state which alternative, based on PI, is more desirable.

3.Why do the project rankings differ under the two methods of analysis? Which alternative would you recommend, and why?

Definitions:

Geometric Average

A method of calculating the average rate of return that considers the compounding effect of returns over time.

Risk-Free Security

An investment that is assumed to be free from any risk of financial loss, typically represented by government bonds.

Arithmetic Return

The simple average of a set of returns over a period.

Q22: Precision Instruments, Inc. is a national firm

Q31: Burmer Co. has accumulated data to use

Q38: The Wentworth Company manufactures modular furniture for

Q49: The net present value (NPV) model of

Q60: Home Remodeling Inc. recently obtained a short-term

Q82: Felinas Inc. produces floor mats for cars

Q97: Which one of the following is a

Q98: Which one the following is a variable

Q103: Which of the following statements regarding cost

Q118: An accounting statement that presents predicted amounts