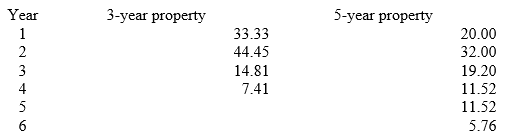

Marc Corporation wants to purchase a new machine for $400,000. Management predicts that the machine will produce sales of $275,000 each year for the next 5 years. Expenses are expected to include direct materials, direct labor, and factory overhead (excluding depreciation) totaling $80,000 per year. The company uses MACRS for depreciation. The machine is considered to be a 3-year property and is not expected to have any significant residual value at the end of its useful life. Marc's combined income tax rate, t, is 40%. Management requires a minimum after-tax rate of return of 10% on all investments. A partial MACRS depreciation table is reproduced below. What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

What is the after-tax cash inflow in Year 1 from the proposed investment (rounded to the nearest thousand) ?

Definitions:

Mental Age

Mental Age is a concept used to describe the level of intellectual development as compared to an average person's development at a certain age, often used in assessing intellectual capabilities in children.

Chronological Age

The exact age of an individual measured in years from the date of birth to the current date.

Alfred Binet

A French psychologist best known for creating the first intelligence test, the Binet-Simon scale.

Intelligence Test

A method of assessing an individual's mental aptitudes and comparing them with others using numerical scores.

Q1: Minmax Co.'s direct labor information for

Q5: In preparing a budget for the first

Q6: Omaha Plating Corporation is considering purchasing a

Q15: The management accountant at Iang Manufacturing

Q15: An organization's overall management accounting and control

Q16: Premium Beds is a retailer of luxury

Q43: New Hope Corporation manufactures replacement windshield wiper

Q77: Zero-base budgeting (ZBB) differs from traditional budgeting

Q119: Harris Corporation provides the following data on

Q158: All of the following capital budgeting decision