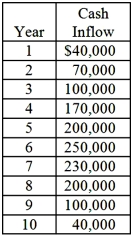

Nelson Inc.is considering the purchase of a $600,000 machine to manufacture a specialty tap for electrical equipment.The tap is in high demand and Nelson can sell all that it could manufacture for the next ten years, the government exempts taxes on profits from new investments.This legislation will most likely remain in effect in the foreseeable future.The equipment is expected to have ten years of useful life with no salvage value.The firm uses the double-declining-balance depreciation method and switches to the straight-line depreciation method in the last four years of the asset's 10-year life.Nelson uses a rate of 10% in evaluating its capital investments.The net cash inflows are expected to be as follows:  Note: PV $1 factors, at 10%: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; year 6 = 0.564; year 7 = 0.513; year 8 = 0.467; year 9 = 0.424; year 10 = 0.386. The PV annuity factor for 10 years, 10% = 6.145.

Note: PV $1 factors, at 10%: year 1 = 0.909; year 2 = 0.826; year 3 = 0.751; year 4 = 0.683; year 5 = 0.621; year 6 = 0.564; year 7 = 0.513; year 8 = 0.467; year 9 = 0.424; year 10 = 0.386. The PV annuity factor for 10 years, 10% = 6.145.

Required:

1. What is the estimated net present value (NPV) of this proposed investment, rounded to the nearest thousand (e.g., $34,480 = $34,000)?

2. What is the estimated internal rate of return (IRR) on this project, rounded to the nearest whole % (e.g., 20.34% = 20%; 20.52% = 21%, etc.)? (Note: Students would have to have access to Excel to answer this question.)

3. What is the present value payback period for this proposed investment, in years (rounded to one decimal place)?

Definitions:

Spillover Hypothesis

Hypothesis that there is a carryover of cognitive gains from work to leisure that explains the positive relationship between activities in the quality of intellectual functioning.

Moral Thought

The process of thinking about, and making judgments regarding, the rightness or wrongness of human actions.

Kohlberg

A theorist known for his work in the development of moral reasoning, proposing stages through which individuals progress as they mature.

Gilligan

A psychologist known for her work in gender differences in morality and ethical decision-making, challenging traditional theories by introducing a feminine perspective.

Q13: Maintenance expenses of a company are

Q20: In performing short-term CVP analysis for a

Q40: Which one of the following statements concerning

Q62: McAllister Company's master budget for the year

Q96: In the current year, Becker Sofa Company

Q103: What is zero-base budgeting (ZBB) and how

Q111: Capital One produces a single product, which

Q113: Done on a regular basis, relevant cost

Q137: The make-or-buy (i.e., sourcing) decision can (most

Q143: The master budget for a given accounting