Fresplanade Co. had the following historical collection pattern for its credit sales:

75% collected in the month of sale

12% collected in the first month after month of sale

8% collected in the second month after month of sale

3% collected in the third month after month of sale

2% uncollectible

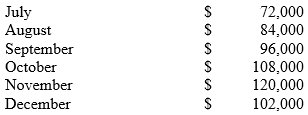

The sales on open account (credit sales) have been budgeted for the last six months of the year as shown below: The estimated cash collections during July from credit sales made in July by Fresplanade Co. is:

The estimated cash collections during July from credit sales made in July by Fresplanade Co. is:

Definitions:

Total Liabilities

Total Liabilities represent the sum of all financial obligations a company owes to outside parties, including loans, accounts payable, and mortgages.

Note Payable

A financial obligation or loan evidenced by a written promise to pay a specific amount on a future date or over a certain period.

Current Liability

Financial obligations or debts that a company is expected to settle within one year or within its normal operating cycle.

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or within the business's normal operating cycle, whichever is longer.

Q20: Burmer Co. has accumulated data to use

Q36: Net Realizable Value (NRV) of a product

Q51: Volume-based rates produce inaccurate product cost when:<br>A)A

Q59: Label Corp. recorded sales of $2,235,245 for

Q68: Which is not a common method used

Q82: Preston Industries, Inc. currently manufactures part QX100,

Q94: The contribution margin per machine hour for

Q102: Stoltenberg Co. had the following information

Q117: The identification of cost drivers is perhaps

Q119: Harris Corporation provides the following data on