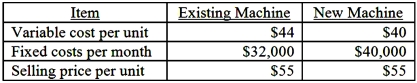

Grey Company is considering replacing its existing cutting machine with a new machine that, according to the manufacturer, is more efficient in terms of energy consumption-a variable cost of production.In this regard, it would like to do some financial planning, including "what-if" analysis.Budgeted information regarding the two machines is as follows:  Required:

Required:

1.Determine the sales volume at which the costs are the same for both machines.

2.What amount of sales, in dollars, for the new machine would produce a 10% profit margin (i.e.ratio of operating profit to sales = 10%)?

Definitions:

Intuition

The capacity to grasp concepts instantaneously, without relying on deliberate thought.

Overconfident

A psychological condition where an individual's belief in their own abilities or chances of success exceeds reality.

Hindsight Bias

The inclination to think that one could have predicted an outcome after it has occurred, commonly known as the "I-knew-it-all-along" effect.

Scientific Inquiry

The process of systematically gathering and evaluating evidence to answer questions and test hypotheses about the natural world.

Q15: Pique Corporation wants to purchase a new

Q32: An overhead cost that can be traced

Q34: Landry Co. had the following information for

Q54: Cleaning Care Inc. expects to sell 10,000

Q60: Place the five steps in implementing a

Q70: Which of the following would likely be

Q80: Quip Corporation wants to purchase a new

Q82: Felinas Inc. produces floor mats for cars

Q92: Management accountants are frequently asked to analyze

Q144: Madson Company is analyzing several proposed investment