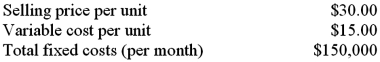

Fashions, Inc.is a retail store that sells sweaters and jackets.In the past, it has bought all its sweaters from a supplier for $20 per unit and had no fixed costs for this line of clothing.However, Fashions has the opportunity to acquire a small manufacturing facility where it could produce its own sweaters.The projected data for producing its own sweaters are as follows:  Required:

Required:

1.If Fashions acquired the manufacturing facility, how many sweaters would it have to produce in order to break even? (Round your answer up, to the nearest whole number.)

2.To earn an after tax profit of $125,000 per month, how many sweaters would Fashions have to sell if it buys the sweaters from the supplier? If it produces its own sweaters? Fashion's combined income tax rate is 30%.(Round your answer up, to the nearest whole number.)

3.What is the profit-indifference sales volume in terms of the two options under consideration? (Ignore income tax effects.) Show a computation of operating income to prove your answer.

Definitions:

Musculoskeletal Pain

Pain that affects the bones, muscles, ligaments, tendons, and nerves, which can be caused by injury, activity, or certain diseases.

Fatigue

A state of physical or mental exhaustion or weakness, often resulting from stress, lack of sleep, or illness.

Perception of Pain

describes the individual and subjective experience of pain, which varies greatly from person to person and can be influenced by numerous factors both physical and psychological.

Analgesia

The state of being unable to feel pain, often achieved through the use of medications.

Q6: Which one of the following process costing

Q13: Maintenance expenses of a company are

Q14: Which of the following is not an

Q16: A negotiated budgeting process is:<br>A) Less effective

Q61: Which one of the following methods of

Q71: Daley Co.manufactures computer monitors.Following is a summary

Q78: Landry Co. had the following information for

Q89: Brownsville Novelty Store prepared the following budget

Q99: Sensitivity analysis is used in capital budgeting

Q163: Quip Corporation wants to purchase a new