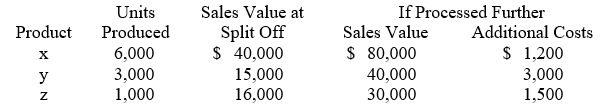

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product X using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product X using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Economic Profits

The surplus achieved when the revenue from business activities exceeds both the explicit and implicit costs, differing from accounting profits by considering opportunity costs.

Accounting Profits

The total revenue of a company minus total explicit costs; the profit figure reported in financial statements.

Marginal Revenue

The additional income received from the sale of one more unit of a product or service.

Competitive Market

A market environment where numerous sellers and buyers exist, ensuring no single entity can dictate the price of a product or service.

Q3: A Production Cost Report summarizes all except:<br>A)The

Q66: A measure of the statistical reliability of

Q66: Kelvin Co. produces and sells socks. Variable

Q78: The following information pertains to MacKenzie Corp.:<img

Q80: A comprehensive or overall formal plan for

Q98: Departmental overhead rates are preferred over plantwide

Q102: A firm has many products, some produced

Q108: Carter Inc. produces two products, A and

Q132: Orange Computer Co. is quickly becoming a

Q133: Processing sales returns and allowances is usually