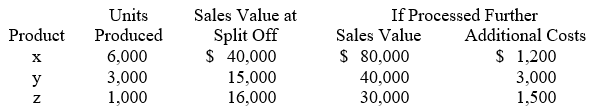

Garrison Co. produces three products — X, Y, and Z — from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Last year all three products were processed beyond split-off. Joint production costs for the year were $120,000. Sales values and costs needed to evaluate Garrison's production policy follow. The amount of joint costs allocated to product Y using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

The amount of joint costs allocated to product Y using the net realizable value method is (calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Indirect Labor Costs

Expenses related to employees who do not directly work on a product but are necessary for the production process, such as maintenance personnel.

Job-order Costing

An accounting method where costs are assigned to each individual job, commonly used in custom or batch production environments.

Work in Process

Items in various stages of completion in the production process, not yet finalized as finished goods.

Finished Goods

Items that have finished being made and are available for purchase.

Q12: Wings Co. budgeted $555,600 manufacturing direct wages,

Q29: Conrad, Inc. recently lost a portion

Q32: Pasternik Company produces and sells two

Q33: Stylish Sitting is a retailer of office

Q51: Volume-based rates produce inaccurate product cost when:<br>A)A

Q68: Sterling Glass Company uses the high-low method

Q84: Midgett Co. has accumulated data to use

Q85: The shadow price in a linear programming

Q95: The equation method for CVP analysis:<br>A) Can

Q138: Salich Manufacturing Corporation has provided the following