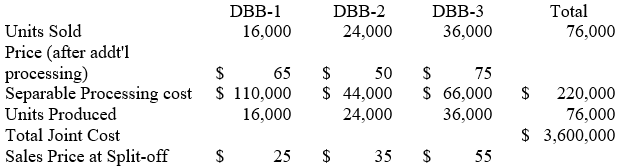

Marin Products produces three products — DBB-1, DBB-2, and DBB-3 from a joint process. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities, and production costs of further processing are entirely variable and traceable to the products involved. Key information about Marin's production, sales, and costs follows.

The amount of joint costs allocated to product DBB-3 using the net realizable value method is (calculate all ratios and percentages to 2 decimal places, for example 33.33%, and round all dollar amounts to the nearest whole dollar) :

Definitions:

Strip Bond

A financial instrument resulting from the separation of the coupon payments and the principal of a regular bond, where each part is sold separately as a zero-coupon bond.

Market Yield

The return on investment for a security anticipated in the marketplace, reflecting its current price and income it generates.

Compounded Semi-Annually

Interest calculation method where the interest is added to the principal balance twice a year, leading to interest on interest.

Market Rate

The prevailing interest rate available in the marketplace, often used as a benchmark for setting loan or investment interest rates.

Q9: The type of compensation plan that focuses

Q12: Georgia Meadows Company uses the high-low

Q23: Revision of a completed and approved budget:<br>A)

Q45: Assume the following information pertaining to

Q53: How will unit (average) cost of manufacturing

Q68: Sterling Glass Company uses the high-low method

Q76: The income statement for a merchandising company

Q81: Operation costing uses which of the following

Q93: Condor Airplane Company has built a new

Q125: Fresplanade Co. had the following historical collection