Demski Company has used a two-stage cost allocation system for many years.In the first stage, plant overhead costs are allocated to two production departments, P1 and P2, based on machine hours.In the second stage, Demski uses direct labor hours to assign overhead costs from the production departments to individual products A andB.

Budgeted factory overhead costs for the year are $300,000.Both the budgeted and actual machine hours in P1 and P2 are 12,000 and 28,000 hours, respectively.

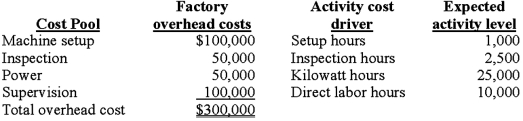

After attending a seminar to learn the potential benefits of adopting an activity-based costing system (ABC), Ted Demski, the president of Demski Company, is considering implementing an ABC system.Upon his request, the controller at Demski Company has compiled the following information for analysis:

Demski manufactures two types of product, A and B, for which the following information is available:

Demski manufactures two types of product, A and B, for which the following information is available:

Required:

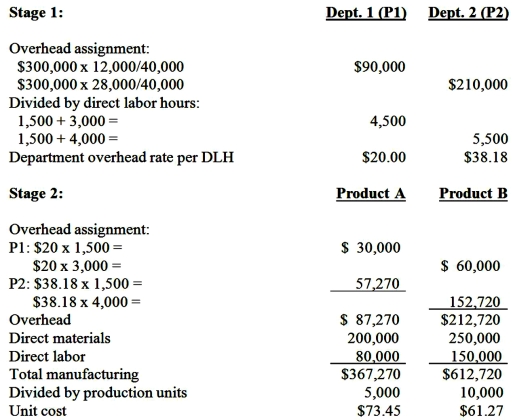

1.Determine the unit cost for each of the two products using the traditional two-stage allocation method.Round calculations to 2 decimal places.

2.Determine the unit cost for each of the two products using the proposed ABC system.

3.Compare the unit manufacturing costs for product A and product B computed in requirements 1 and 2.

(a) Why do two the cost systems differ in their total cost for each product?

(b) Why might these differences be important to the Demski Company?

Answer may vary

Feedback: 1.Unit cost for each of two products using the traditional two-stage allocation method:

Definitions:

5-HTTLPR Gene

A variation in the genetic sequence of the serotonin transporter gene, which is thought to impact the efficiency of serotonin transport and has been associated with susceptibility to depression and anxiety disorders.

Allele

Alternate versions of a gene, which develop through mutation and exist at the same position on a chromosome.

Intervention Study

A research method involving the intentional action or treatment applied to study subjects to observe its effects, often used in medical and psychological studies.

Constructive

Serving a useful and positive purpose, often implying the building up or improvement of something.

Q8: ABC.Ltd.had unused allowable capital losses of $20,000

Q10: In 20X0,Coffee Co.recognized $37,000 in business income

Q25: National Inc. manufactures two models of CMD

Q33: All of the following are required resources

Q44: Which of the following methods accurately represents

Q54: By-product costing that uses the asset recognition

Q61: A manager uses regression to express sales

Q76: General corporate sales expenditures are:<br>A)Customer unit-level costs.<br>B)Customer

Q78: The Long Term Care Plus Company has

Q105: Whittenberg Distributors, a major retailing and mail-order