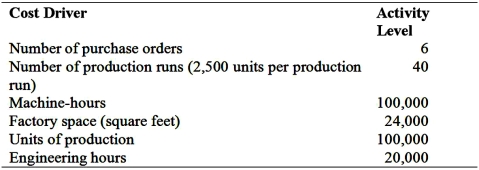

Cost Pools and Cost Drivers Based on a recent study of its manufacturing operations Johnston Manufacturing Corporation has identified six resource consumption cost drivers.These cost drivers and their budgeted activity levels for the coming year are:  The firm has budgeted the following costs for the year: With the exception of the factory space cost pool, which uses machine-hours as the activity consumption cost driver, other cost pools have identical resource and activity consumption cost drivers.

The firm has budgeted the following costs for the year: With the exception of the factory space cost pool, which uses machine-hours as the activity consumption cost driver, other cost pools have identical resource and activity consumption cost drivers.

Required:

1.Identify the most appropriate activity cost pool for each of the cost items and cost driver for each activity cost pool you identified.

2.Johnston has received a request to quote the price for 4,000 units of a new product.The production will require 100 engineering-hours and 4,250 machine-hours.What is the manufacturing overhead per unit the firm should use in determining the price?

Definitions:

Discount Period

The time frame between the beginning of a loan or credit term and the date the full payment is due, during which a discount may be offered for early payment.

Aging Schedule

A report categorizing a company's accounts receivable according to the length of time an invoice has been outstanding, used to determine credit and collection policies.

Uncollectible Accounts Receivable

Money owed to a company that it does not expect to collect due to the debtor's inability to pay.

Bad Debt Expense

This represents the amount of receivables a company believes it can no longer collect, reflecting potential losses for accounts receivable or loans that are not expected to be fully paid.

Q1: Tom and Bob are equal shareholders of

Q4: Tony Brown sold 5000 of his shares

Q5: Which of the following is not a

Q5: The Flower Company is for sale.The anticipated

Q10: Pierce Co. manufactures a single product that

Q39: Maintenance expenses of a company are

Q72: Customer profitability analysis:<br>A)Always shows that the company

Q87: Randall Company manufactures products to customer

Q89: Factory overhead costs for a given period

Q119: The standard error of the estimate (SE)