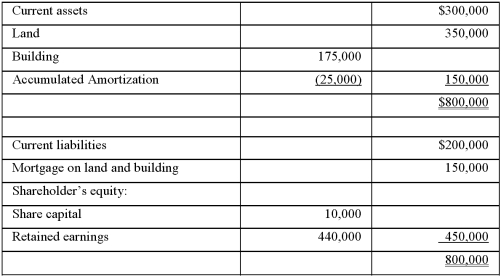

Mountain Wear Inc.(MWI)is a Canadian-controlled private corporation owned 100% by Fred Martin.The ACB of Fred's shares in MWI is $10,000.The year-end balance sheet for MWI is as follows:  Additional information is available for MWI:

Additional information is available for MWI:

The current assets consist of accounts receivables and inventory,which have costs equal to their market values.

The UCC of the building is $160,000.

The land is currently valued at $450,000.

The building has a FMV of $205,000.

Additionally:

Fred has used all of his capital gains exemption.

MWI is not associated with any other corporations for tax purposes.

Fred has recently been offered $450,000 for his shares by a local competitor.

Fred is in a 45% tax bracket.

Due to the timing of the sale,if assets are sold,the small business deduction will be available.

Assume a 15% tax rate on earnings subject to the small business deduction.

Assume a combined 44 2/3% tax rate on corporate investment income.

Required:

A)Calculate the after-tax proceeds of the sale if the shares of MWI are sold.

B)Calculate the amount of proceeds available for distribution if the assets of MWI are sold.

C)If the proceeds are distributed in a wind-up,what type of taxes will Fred be subject to? (It is not necessary to show calculations for this part of the question.)

Definitions:

Federal Reserve

The central banking system of the United States, which regulates the nation's monetary policy and financial institutions.

Functions

Mathematical relations that uniquely associate elements of one set with elements of another set, often used to model relationships in science and economics.

Intrinsic Value

The inherent worth of an asset, independent of its market price, determined by its fundamental characteristics and earning potential.

Prisoners

Individuals who are held in confinement as a punishment for crimes or while awaiting trial.

Q10: The cover letter for your résumé sent

Q16: Moss Manufacturing has just completed a

Q24: Randall Company manufactures products to customer

Q37: Williams Instruments manufactures specialized surgical equipment for

Q49: _ occurs when the salesperson is not

Q65: Cost management has moved from a traditional

Q66: In six months you are scheduled to

Q76: Which of the following statements is true

Q92: Which of the following occurs in the

Q93: A time ticket:<br>A)Shows the time an employee