(Originally "Problem Eleven" from Chapter Six in previous editions of the textbook)

Alpha Ltd.is a Canadian-controlled private corporation operating a small land-development business.In June 20X2,it acquired a license to manufacture pre-fab homes and began operations immediately.Financial information for the 20X2 taxation year is outlined below:

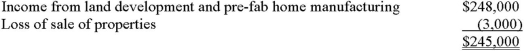

Alpha's profit before income taxes for the year ended November 30,20X2,was $245,000,as follows:  The loss on sale of property results from two transactions.On October 1,20X2,Alpha sold all of its shares of Q Ltd.,a 100% subsidiary,for $100,000.(The shares were acquired seven years ago for $80,000.)Also,during the year,Alpha sold some of its vehicles for $25,000.The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale.New vehicles were obtained under a lease arrangement.

The loss on sale of property results from two transactions.On October 1,20X2,Alpha sold all of its shares of Q Ltd.,a 100% subsidiary,for $100,000.(The shares were acquired seven years ago for $80,000.)Also,during the year,Alpha sold some of its vehicles for $25,000.The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale.New vehicles were obtained under a lease arrangement.

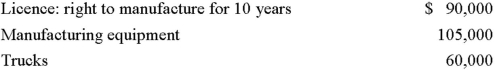

The 20X1 corporate tax return shows the following UCC balances:  Alpha occupies leased premises under a seven-year lease agreement that began three years ago.At the time,Alpha spent $60,000 to improve the premises.The lease agreement gives Alpha the option to renew the lease for two three-year periods.Alpha began manufacturing pre-fab homes on June 1,20X2.At that time,it acquired the following:

Alpha occupies leased premises under a seven-year lease agreement that began three years ago.At the time,Alpha spent $60,000 to improve the premises.The lease agreement gives Alpha the option to renew the lease for two three-year periods.Alpha began manufacturing pre-fab homes on June 1,20X2.At that time,it acquired the following:  Accounting amortization in 20X2 amounted to $60,000.

Accounting amortization in 20X2 amounted to $60,000.

Alpha normally acquires raw land,which it then develops into building lots for resale to individuals or housing contractors.In 20X2,it sold part of its undeveloped land inventory to another developer for $400,000.The sale realized a profit of $80,000,which is included in the land-development income above.The proceeds consisted of $40,000 in cash,with the balance payable in five annual instalments beginning in 20X3.

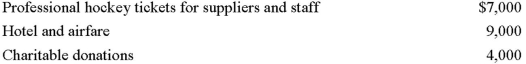

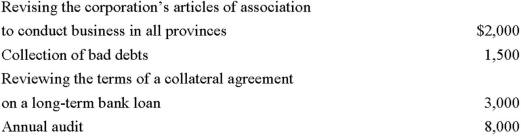

Travel and entertainment expense includes the following:  Legal and accounting expense includes the following:

Legal and accounting expense includes the following:  Required:

Required:

Calculate Alpha's net income for tax purposes for the 20X2 taxation year.

Definitions:

Q1: Cost system design/selection should consider all but

Q3: Volume-based cost accounting systems often do a

Q5: Alice Smith has provided you with the

Q10: Sutherland Company listed the following data

Q19: Many products in the marketplace today are

Q29: In which of the following scenarios is

Q49: Salespeople can help customer service by setting

Q67: Anton has determined the facts in his

Q89: Factory overhead costs for a given period

Q99: Jack has just received a complaint from