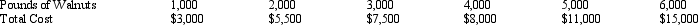

Exhibit 12-8 The long-run total cost schedule of a perfectly competitive firm that produces walnuts is as follows: Refer to Exhibit 12-8.The average total cost of producing 2,000 pounds of walnuts in the long run is:

Refer to Exhibit 12-8.The average total cost of producing 2,000 pounds of walnuts in the long run is:

Definitions:

Taxable Income

The portion of an individual's or corporation's income used to determine how much tax is owed to the federal government or other taxing authorities.

Tax Liability

The total amount of tax that an individual or business is legally obligated to pay to a tax authority based on earnings or profit.

Qualifying Widow(er)

A tax filing status available to a widowed individual who has a dependent child, offering the same tax benefits as married filing jointly for two years following the spouse's death.

Dependent Child

A child who meets certain IRS criteria, thereby allowing the taxpayer to claim certain tax benefits, such as the child tax credit.

Q6: A firm in a perfectly competitive industry

Q10: Exhibit 10-3 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2081/.jpg" alt="Exhibit 10-3

Q23: Which of the following is not a

Q25: The line joining the old and new

Q35: A Texas oil woman would like to

Q49: The ability to pay principle suggests that:<br>A)

Q51: Which of the following characterizes an oligopolistic

Q114: Reduction in quantity demanded of a good

Q160: Economies of scale:<br>A) are the result of

Q165: Exhibit 13-3 A monopoly producer of canned