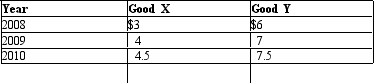

Suppose a consumer buys 10 units of good X and 20 units of good Y every year.The following table lists the prices of goods X and Y in the years 2008-2010.Assume that these two goods constitute the typical market basket.Calculate the price indices for these years with 2008 as the base year.Comment on the inflation picture for these years.

Definitions:

Accounts Receivable Approach

The accounts receivable approach is a method used in financial analysis to estimate the impact of credit sales and receivables on a company's cash flow and profitability.

Net Present Value

Net present value (NPV) is a financial metric that calculates the difference between the present value of cash inflows and the present value of cash outflows over a period of time, used in capital budgeting to assess the profitability of an investment.

Cost Of Switching

The cost of switching refers to the expenses and inconveniences a customer or company faces when changing products, services, or suppliers, including termination fees, setup costs, and time.

Incremental Cash Inflow

Additional cash earnings a company receives from undertaking certain actions, such as launching a new product or project.

Q14: Changes in the growth rate of real

Q17: A person who works 25 hours per

Q49: Based on the table below,how many workers

Q53: The SRAS is _; the LRAS is

Q62: The natural rate of unemployment:<br>A) is the

Q68: If a country's annual growth rate is

Q87: Since 1950,there has been _ in the

Q121: If a large number of skilled workers

Q144: Unemployment that results from an economy-wide downturn

Q146: The additional revenue a firm obtains from