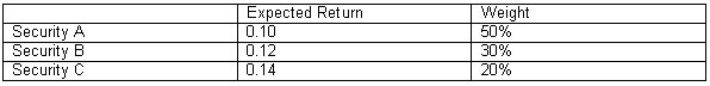

Calculate the expected return from a portfolio consisting of three securities with the following expected returns and weights:

Definitions:

Risk-Free Asset

An investment that is expected to deliver its return with certainty, with government bonds often considered as the closest example.

Risky Portfolio

An investment portfolio that contains assets with higher volatility and potential for significant variations in returns, offering the possibility of higher gains at the risk of greater losses.

Expected Rate of Return

The average return that an investor anticipates to earn on an investment, considering all potential outcomes and their probabilities.

Expected Return

The weighted average of all possible returns for a given investment, considering the probabilities of each outcome.

Q7: Studies,which show that taxes affect marginal financing

Q21: A limitation of the chain of replacement

Q25: A bill either accepted or endorsed by

Q38: Tow Ltd plans to expand its fleet

Q45: Red Brick Ltd is considering replacing its

Q50: If all shareholders take up a rights

Q52: Most marketable long-term debt securities have a

Q53: If it is feasible to undertake a

Q56: Project B has a cost of $23

Q66: This is a grant of stock with