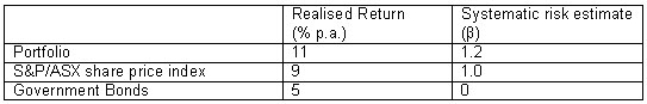

An investor would like to evaluate the performance of her portfolio using the Treynor ratio.The past year realised return and systematic risk of the portfolio,the benchmark portfolio,given by the S&P/ASX share price index,and government bonds are:

Has the portfolio:

Definitions:

Cost of Goods Sold

The immediate expenses directly linked to the manufacturing of products sold by a firm, such as labor and materials used.

Finished Goods Inventories

The stock of completed products that are ready to be sold but have not yet been purchased or distributed.

Credit Balance

The amount of money credited to an account, indicating the sum that a financial institution or vendor owes to the account holder.

Manufacturing Overhead

A rephrasing of Factory Overhead, encompassing all indirect costs associated with the manufacturing process, such as utilities, maintenance, and management salaries.

Q6: If expected inflation over the next year

Q6: The benefit-cost ratio is also known as

Q12: Merchant or investment banks are classified under

Q14: The best security to achieve immunisation is:<br>A)a

Q19: Which of the following is not a

Q28: Break-even analysis can be defined as:<br>A)analysis of

Q42: A security market line:<br>A)explains the co-variance between

Q48: Mehra and Prescott (1985)showed that a long-term

Q49: Maintaining reserve borrowing capacity:<br>A)can help overcome the

Q56: Which of the following statements is false?<br>A)Simulation,unlike