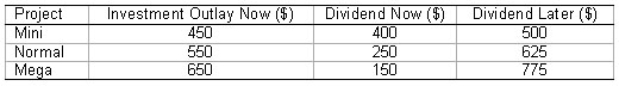

Consider the following investment/dividend opportunities facing a company:

Assume that the interest rate in the capital market is 12 per cent per period,and that the company has four equal shareholders (A,B,C and D) .Also assume the company has chosen Projects Normal and Mega for investment.Suppose Shareholder B wishes to consume $165 now.What is his required repayment in the later period?

Definitions:

Excess Inventory

Inventory that exceeds the optimal level, often leading to additional storage costs and potential obsolescence.

Aggregate Plan

A strategic framework used in production and operations management to determine the necessary production levels, inventory, and workforce to meet anticipated demand.

Capacity

The maximum amount that something can contain or accomplish, such as production capability within a given period.

Aggregate Plan

A production planning method that aims to establish overall output levels and inventory policies over a medium-term horizon to meet forecasted demand.

Q1: Risk management decisions are based on the:<br>A)

Q3: A method which involves calculating the annual

Q10: Usually,CEO pay is determined by:<br>A) market forces

Q11: The annuity where the cash flows continue

Q16: Typically,a company employs the services of an

Q27: A financial contract is:<br>A)a piece of advice

Q42: A government document that creates a corporation

Q43: Ethnic nepotism refers to systematic efforts made

Q46: A(n)_ is an animated,interactive realm of plants,animals,and

Q52: Consider the following investment/dividend opportunities facing a