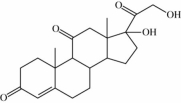

This is the structure of the steroid known as

Definitions:

Deferred Tax Asset

An accounting item that refers to a situation where a business has paid more taxes in advance than its current tax liability, or has carryover of losses that can be used to lower future tax payments.

Year-end Deferred Income Taxes

Taxes on income that is earned in one accounting period but not paid until another, resulting from timing differences between accounting recognition and the tax laws.

Net Operating Loss

A period when a company's allowable tax deductions exceed its taxable income, potentially reducing future taxable income.

Deferred Income Taxes

Taxes that are payable in a future period due to temporary differences between financial accounting and tax reporting.

Q5: What chemicals replaced CFCs as polymer blowing

Q15: In this electrochemical cell,the reduction half reaction

Q16: Why is water a liquid a room

Q20: Which compound cannot exist as a pair

Q37: Translation is the process by which<br>A)copies of

Q41: What is meant by malnutrition?<br>A)More calories than

Q63: Soft lignite (brown coal)is the lowest grade

Q67: The distinctive arrangements of atoms that impart

Q132: Work-life balance refers to the length of

Q162: One survey reported that most Canadian would