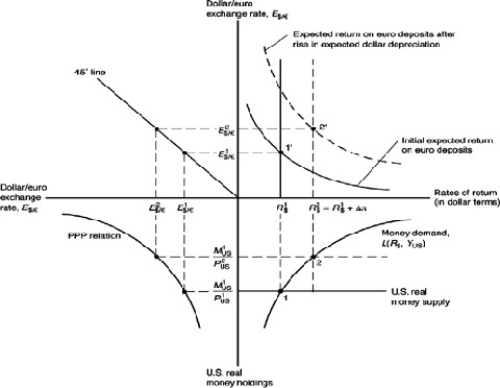

To answer the following question,please refer to the figure below.Concentrating only at the lower left quadrant,discuss the relationship between the U.S.real money supply and the dollar/euro exchange rate,E$/E.

Definitions:

Multicollinearity

A statistical phenomenon where two or more predictor variables in a multiple regression model are highly correlated, potentially distorting estimates.

Correlation Coefficient

The correlation coefficient is a statistical measure that calculates the strength and direction of the relationship between two variables, ranging from -1 to 1.

Variance Inflation Factor

A measure of how much the variance of an estimated regression coefficient increases if your predictors are correlated.

Independent Variables

Factors within an experiment or model that are intentionally altered to study their impact on outcome variables.

Q9: Money demand behavior may<br>A)change as a result

Q14: An import quota is similar to a

Q15: Explain what is a "vehicle currency." Why

Q18: Comparing fixed to flexible exchange rate,the response

Q19: The Heckscher-Ohlin,factor-proportions model lends support to the

Q35: Define the concept of the real exchange

Q43: When the domestic money prices of goods

Q51: Maintaining a fixed exchange rate over the

Q69: Complaints are often made to the International

Q77: Countries with the<br>A)biggest deflations and output contractions