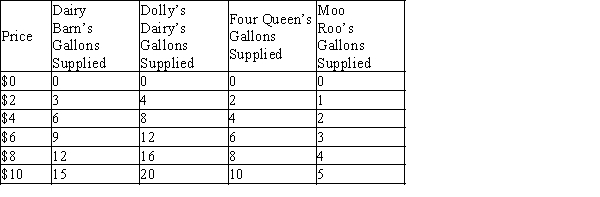

Table 4-7

-Refer to Table 4-7. If these are the only four sellers in the market for ice cream, then when the price decreases from $10 to $8, the market quantity supplied decreases by

Definitions:

Weighted Average Cost of Capital (WACC)

This metric calculates a firm's cost of capital, considering the proportionate costs of each component of the capital structure.

Internal Rate of Return (IRR)

The discount rate at which the net present value of all cash flows (positive and negative) from a project or investment equals zero.

Weighted Average Cost of Capital (WACC)

WACC represents the average rate that a company is expected to pay to finance its assets, weighted by the proportion of debt and equity financing.

Terminal Value (TV)

Value of operations at the end of the explicit forecast period; it is equal to the present value of all free cash flows beyond the forecast period, discounted back to the end of the forecast period at the weighted average cost of capital.

Q165: For a good that is a luxury,

Q202: Refer to Figure 3-21. If Uzbekistan and

Q226: Refer to Table 4-15. Assuming these are

Q328: Refer to Figure 4-6. Suppose that the

Q385: Refer to Figure 4-26. Which of the

Q385: If a country has a lower opportunity

Q430: Today, producers changed their expectations about the

Q439: The line that relates the price of

Q527: Suppose scientists provide evidence that people who

Q687: In competitive markets,<br>A) firms produce identical products.<br>B)