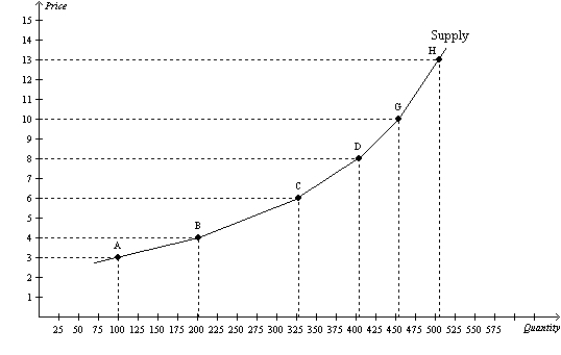

Figure 5-15

-Refer to Figure 5-15.Using the midpoint method,what is the price elasticity of supply between points C and D?

Definitions:

Tax

An inescapable financial demand or another sort of fee imposed on a taxpayer by an arm of the government to fulfill government spending requisites and diverse expenditures for public services.

Good

An item or product that can be bought, sold, or provided in an exchange and is intended to satisfy a want or need.

Burden

In economic contexts, it often refers to the impact of taxes or regulations on individual or corporate finances.

Tax

Mandatory financial contributions imposed by governments on individuals, businesses, or transactions to finance government activities.

Q8: The supply of oil is likely to

Q133: If the government removes a $1 tax

Q252: The OPEC oil cartel has difficulty maintaining

Q256: If a tax is levied on the

Q304: If the income elasticity of demand for

Q358: When the market price is below the

Q479: Which of the following should be held

Q487: Suppose that 50 hot dogs are demanded

Q516: OPEC successfully raised the world price of

Q622: When a tax is placed on the