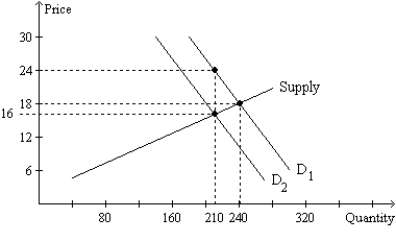

Figure 6-24

-Refer to Figure 6-24.The per-unit burden of the tax on buyers of the good is

Definitions:

Common Stock

A type of security that signifies ownership in a corporation, entitling the holder to a share of the company's assets and profits.

Pre-Tax Cost of Debt

The interest rate a company pays on its borrowings before taking into account any tax deductions.

Zero-Coupon Bonds

Zero-coupon bonds are debt securities that are issued at a discount to their face value and don’t pay interest before maturity; instead, investors receive the face value at maturity.

Face Value

The nominal or dollar value printed on a bond, bill, or other financial instrument, representing the amount due at maturity.

Q17: Suppose that the demand for picture frames

Q240: Refer to Figure 6-22. How much tax

Q274: In 2012, the U.S. minimum wage according

Q416: Supply and demand both tend to be

Q418: If a tax is levied on the

Q454: The income elasticity of demand is defined

Q473: Along the elastic portion of a linear

Q550: Refer to Figure 6-9. At which price

Q556: Refer to Figure 6-28. Suppose a tax

Q601: A tax on sellers shifts the supply