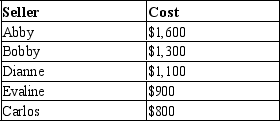

Table 7-11

The following table represents the costs of five possible sellers.

-Refer to Table 7-11. If the market price is $1,200, the producer surplus in the market is

Definitions:

Interest Revenue

Earnings generated from lending money or through investments in interest-bearing financial instruments.

Income Tax Expense

The cost of income taxes a company incurs, reflecting the taxes to be paid to taxation authorities and adjustments to deferred tax assets or liabilities.

Deferred Tax Assets

The amount of income tax recoverable in future reporting periods in respect of deductible temporary differences and tax losses.

Retained Earnings

The portion of net income that is retained by a company rather than distributed to its shareholders as dividends, which is reinvested into business operations.

Q47: Refer to Figure 8-5. The equilibrium price

Q51: Economists generally believe that, although there may

Q193: A tax affects<br>A) buyers only.<br>B) sellers only.<br>C)

Q283: When the price of a good is

Q308: Refer to Scenario 6-2. What are the

Q310: Refer to Figure 8-2. The imposition of

Q420: If the equilibrium wage is $4 per

Q471: Let P represent price; let QS represent

Q483: Refer to Figure 8-5. The tax causes

Q519: The primary effect of rent control in