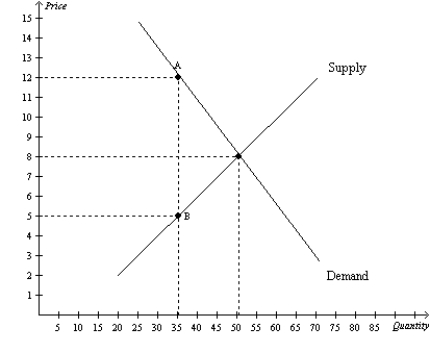

Figure 8-4

The vertical distance between points A and B represents a tax in the market.

-Refer to Figure 8-4.The amount of deadweight loss as a result of the tax is

Definitions:

Materials Price Variance

The difference between the actual amount paid for materials and the expected (or standard) cost of those materials, multiplied by the quantity of materials purchased.

Direct Material Standards

Standard costs set for the quantity and price of materials required for a manufacturing process.

Purchases Variance

A measurement of the difference between the actual cost of materials and the expected, or standard, cost.

Variable Overhead Efficiency Variance

The difference between the actual variable overhead costs incurred and the standard costs for the actual production volume.

Q1: Refer to Figure 8-23. If the economy

Q122: Consider a good to which a per-unit

Q167: Refer to Table 7-11. If the market

Q203: Refer to Figure 8-8. The tax causes

Q272: Assume that for good X the supply

Q321: Suppose a country begins to allow international

Q351: A tax levied on the buyers of

Q354: Refer to Figure 8-9. The amount of

Q378: Total surplus is represented by the area

Q523: Consumer surplus is the amount a buyer