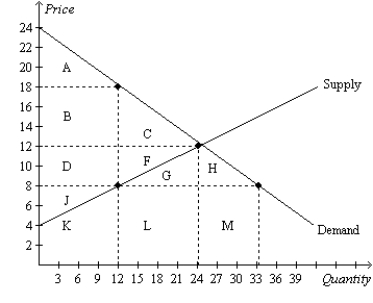

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.The deadweight loss of the tax is the area

Definitions:

Price Level

A calculated mean price for all current economic goods and services.

Inflation Rate

The percentage increase in the general price level of goods and services in an economy over a specified period.

Money Supply

Money Supply denotes the total volume of money available in the economy, including cash, coins, and balances held in checking and savings accounts.

Value of Money

Refers to the purchasing power of money, or how much goods and services a unit of money can buy.

Q37: Refer to Figure 8-1. Suppose the government

Q38: The Surgeon General announces that eating chocolate

Q40: All else equal, a decrease in demand

Q89: Refer to Figure 8-6. Total surplus with

Q198: The Laffer curve is the curve showing

Q269: Total surplus in a market will increase

Q353: Taxes drive a wedge into the market

Q376: Refer to Figure 7-22. If the price

Q387: Refer to Figure 9-6. The size of

Q440: Suppose a tax of $1 per unit